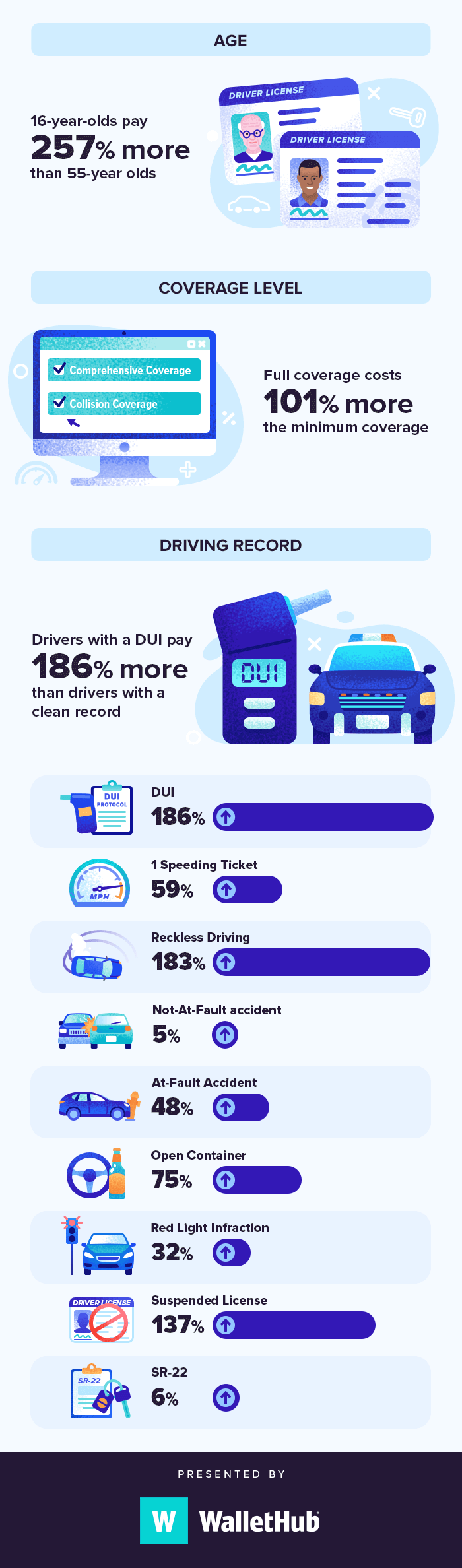

To understand how a moving offense will certainly impact your prices, we ran a study and located that the extra cost could run from 5% to as high as 20%. Can a teen obtain their own cars and truck insurance plan? Firms will sell straight to teenagers. Nevertheless, state regulations vary when it concerns a teenager's capability to sign for insurance policy.

Your teen will likely have a greater costs compared to including a teenager to a moms and dad or guardian policy. Nonetheless, there are situations where it may make good sense for a teenager to have their very own plan. Progressive points out 2: You have a deluxe sporting activities car. business insurance. On a solitary plan, all motorists, including the teenager, are guaranteed versus all autos.

Vehicle insurance policy is various for a newbie auto insurance coverage purchaser, yet it's an excellent time to begin a partnership with an insurance provider. Just how to save money on adolescent automobile insurance coverage? Teenagers pay even more for vehicle insurance than adult chauffeurs because insurance suppliers consider them risky. Yet there are ways teen motorists can save money on their vehicle insurance policy costs - insurers.

low-cost auto insurance cheap cheaper car insurance car

low-cost auto insurance cheap cheaper car insurance car

Weigh versus the truth that young drivers are extra likely to obtain into mishaps. You can also go down extensive and collision insurance coverage if the automobile isn't financed as well as not worth much.

Not known Details About How Much Is Car Insurance For Teen Drivers?

An automobile with a high safety and security ranking will certainly be cheaper to guarantee. Use com's checklist of vehicle designs to find the most affordable cars to insure. This primarily relates to the car's cost, just how very easy it is to fix as well as assert documents. Has a checklist of utilized automobiles. cheap auto insurance. This isn't truly a popular option for an excited teen chauffeur, but it deserves taking into consideration.

trucks car money insure

trucks car money insure

You ought to additionally recognize the insurance company still bill greater rates for the very first couple of years of the certificate. One more way to lessen your insurance policy costs is to make use of yourself of the price cuts readily available. A few of them are discussed below, Discount rates for teenager drivers, We've determined the finest price cuts for teen vehicle drivers to obtain economical cars and truck insurance policy - trucks.

That's $361 on standard. You can take additional motorist education or a protective driving training course. This indicates exceed and also past the minimum state-mandated chauffeurs' education and learning and training. In some states, discounts can range from 10% to 15% for taking a state-approved driver enhancement class. On-line courses are a hassle-free alternative yet contact your service provider first to ensure it will lead to a discount.

dui cheaper auto insurance auto cheapest auto insurance

dui cheaper auto insurance auto cheapest auto insurance

dui insurance company liability cheaper auto insurance

dui insurance company liability cheaper auto insurance

You can obtain a price cut around 5% to 10% of the trainee's premium, however some insurance companies market up the 30% off - vans. The average pupil away at institution discount rate is greater than 14%, which is a cost savings of $404. Maintain a tidy record and also you can get a price cut. This means you do not enter into any kind of mishaps or offenses.

A Biased View of Car Insurance For Teens And New Drivers - State Farm

Several car insurance policy business use discounts if you enable a telematics gadget to be placed in your car so they can check your driving practices. This can offer up to a 45% price cut.

There is possible to save. If the student prepares to leave a car at residence and the college is greater than 100 miles away, the university student can receive a "resident student" discount or a student "away" discount rate, as mentioned over - cheapest car. These price cuts can reach as high as 30%.

insurance affordable insurance business insurance car

insurance affordable insurance business insurance car

That can result in a good trainee price cut. dui. Both discounts will need you to call your insurance coverage service provider so they can begin to use the price cuts. While you're on the phone with them, do not think twice to inquire about various other possible price cuts. Student's authorization insurance coverage, You can obtain insurance policy with an authorization, yet many cars and truck insurance provider include the allowed teenager on the parents' plan without any kind of action.

When that time comes, make certain to see the rest of this short article for support on options and also discount rates. Also, it might be smart to contact your insurance coverage carrier for all alternatives offered to you. Opt for no protection financial savings choice, It's possible to tell your insurance firm not to cover your teenager, yet it's not a provided.

The smart Trick of The Staggering Cost To Insure A Teenage Driver - Forbes That Nobody is Talking About

With an endorsement to your policy, you and your insurance coverage business mutually concur that the chauffeur isn't covered, which means neither is any crash the vehicle driver causes. Not all firms permit this, as well as not all state do either. Adding a teen driver rip off sheet, Talk with your carrier as quickly as your teen obtains a chauffeur's permit - trucks.

com. Consider all protection options. Consider increasing your deductible. Look for out as well as pile as many discount rates as possible. Talk with your teenager early and commonly regarding safety. Urge they drive a secure car. Things to take into consideration prior to choosing an auto insurer for your teenager Opportunities are that your car insurance provider will certainly call you.

Often asked questions concerning teen insurance, Do you have to include an adolescent vehicle driver to your insurance coverage? Yes, you'll need to add your teen to your vehicle insurance plan if they cope with you and drive your cars and truck (insured car). Some states will require you to add your teen chauffeur as an added guaranteed person when they obtain their learner's license.

Should I add my 16-year-old to auto insurance? Most states need Visit website you to include your 16-year-old teenager to your automobile insurance coverage as soon as they get their permit.

Teen Driver? Ways To Cut Insurance, Other Costs - Reuters - Truths

Also if it is not obligatory, it's always a great suggestion to see to it you're covered by auto insurance. automobile. How to get cars and truck insurance policy for a teen? It is feasible for a young adult to get auto insurance with an authorization, however many insurance policy service providers will include the permitted teenager on their parent's plan without any various other formalities. low-cost auto insurance.

Just how much does it set you back to include a 17-year-old to vehicle insurance? The typical vehicle insurance cost for a 17-year-old for full coverage is $5,836 a year - affordable. Your automobile insurance policy rate will rely on where you live, the coverage degree you select, the make and version of your auto, to name a few variables.

That's because 16 is the birthday celebration when teens can begin driving in Ohio. As well as that indicates you have to figure out your teen's automobile insurance policy scenario. Will teen car insurance cover sufficient to keep my youngster shielded?